Data breaches can be devastating for any business, both financially and reputationally. The average cost of a data breach in the United States is around $9.48 million, including legal fees, penalties, and loss of business. In-house bookkeeping systems are often vulnerable to cyber-attacks unless significant investments when do you know to outsource your bookkeeping are made in cybersecurity measures, which can cost upwards of $100,000 for a mid-sized company. It’s important to select a provider that can integrate their services with your startup’s existing accounting system. This allows for a seamless flow of financial data to help manage the business more efficiently.

- At Pilot, your dedicated account manager is always available to support you and answer any questions.

- Remote Books Online offers a streamlined, contemporary solution to businesses seeking efficient, cost-effective, and secure bookkeeping services.

- Read on to learn everything you need to know about outsourced bookkeeping services and whether or not it’s worth doing for your company.

- Bookkeeping and accounting are the navigation systems and fuel gauges, crucial for a successful mission.

- Many small businesses experience significant advantages by embracing outsourced bookkeeping.

Pilot can be used as a standalone web application for accounting or with the support of a dedicated bookkeeping team. The system allows for the direct import of bank transactions and digital statements. For companies with an existing in-house accounting and finance team, partnering with an outsourcing company offers benefits. This collaboration allows current staff to work alongside specialists, gaining expertise in technical areas. The close association with an outsourcing partner provides valuable learning opportunities for the in-house team.

How to Outsource Your Bookkeeping

Here, we’ll explore the benefits of outsourcing your accounting services to help you decide whether it’s a good option for your organization, or not. Managing financial accounts, from bookkeeping to financial reporting, to managing invoices remains a pivotal aspect of any business strategy. Yet, this task can be time-consuming and challenging, especially for SMBs lacking dedicated financial professionals. Therefore, the first thing you need to consider when you outsource bookkeeping for your small business is whether you need basic bookkeeping—compliance—or you’re ready to move on to full-service accounting. The two require different levels of expertise and effort, and as you can imagine, the costs of full-service accounting are higher. Whether you need to outsource data entry services, forecasting, and budgeting, financial reporting, or internal controls, your team is only one phone call away.

Of all the bookkeeping options, outsourcing tends to be the most cost-effective for small businesses. This is because you’re not hiring a full-time staff member or being charged an hourly rate. It’s not unusual for the hourly rate for freelance bookkeepers to range from $21 per hour to $60 per hour.

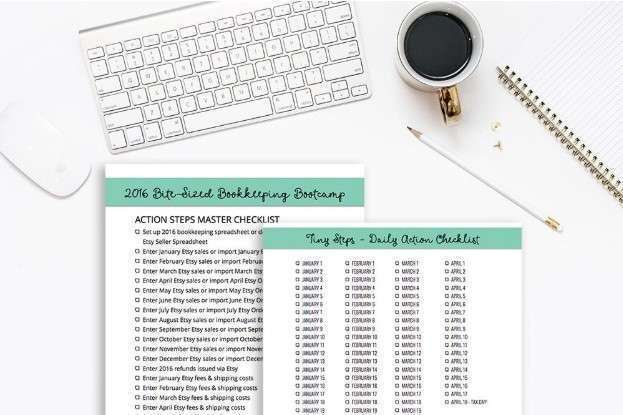

BONUS: Simplify Your Accounting Workflows with This Free Resource

Whether or not to outsource is a common question many small business owners face. Primarily, businesses choose virtual bookkeepers or local bookkeepers. Good bookkeeping firms will be able to warn you if your office costs are too high.